Why It Matters: Completing the Accounting Cycle Financial Accounting

- Posted on

- wadminw

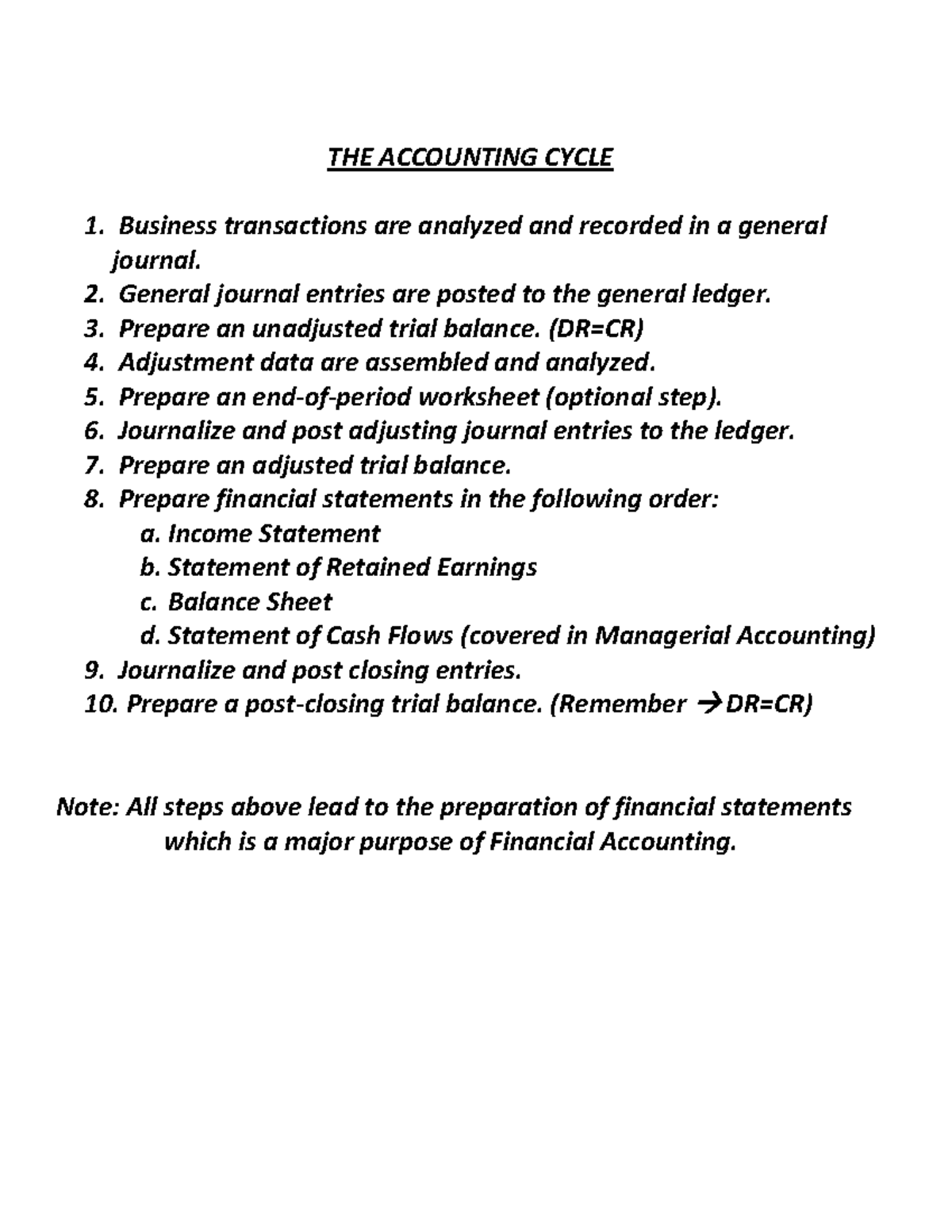

It starts with recording all financial transactions throughout that accounting period and ends with posting closing entries to close the books and prepare for the next accounting period. It’s worth noting that some businesses also have internal accounting cycles that have a shorter accounting period. These internal accounting cycles follow the same eight accounting cycle steps and can last anywhere from one month to six months.

Step 1: Analyzing and Classifying Transactions

If the sum of the debit balances in a trial balance doesn’t equal the sum of the credit balances, that means there’s been an error in either the recording or posting of journal entries. After completing the financial statements at the end of the accounting period, the next step is to record closing entries to get the books ready for the next period. This step transfers account balances from temporary accounts to permanent accounts. You prepare the balance sheet, which comprises assets, liabilities, and owner’s equity information. Next, the income statement uses information from the adjusted trial balance’s revenue and expense account sections.

Step 3: Record journal entries in the general ledger

An adjusted trial balance may be prepared after adjusting entries are made and before the financial statements are prepared. This is to test if the debits are equal to credits after adjusting entries are made. The accounting cycle is a systematic process followed by businesses to record, analyze, and ultimately report financial transactions. It’s an essential aspect of ensuring the accuracy and completeness of a company’s financial statements. The accounting cycle is essential for business because it ensures that the accounting information of any particular business is accurate and valid.

Preparing the Adjusted Trial Balance

The general ledger comprises of multiple ledger accounts, which are the primary components of a business’s financial statements. Each ledger account pertains to a specific aspect of the business, such as assets, liabilities, revenues, or expenses. Each entry in the journal is made up of debits and credits, following the double entry accounting system. For every transaction, there must be at least one debit and one credit entry to ensure that the books remain balanced. For example, if a business purchases office supplies, the supplies account is debited, and the cash account is credited. Because debits and credits must always balance, you must prepare a closing trial balance once you’ve closed out the temporary accounts.

Some popular accounting software options include QuickBooks, Xero, and Zoho Books. It is important to choose the right software that meets the company’s specific needs and integrates 10 steps of the accounting cycle seamlessly with their operations. The Balance Sheet presents the company’s financial position, displaying assets, liabilities, and equity at the end of an accounting period.

Income Statement

Full cycle accounting refers to the complete process of the accounting cycle, from analyzing transactions to preparing financial statements and closing the books for the accounting period. Establishing standardized procedures for recording transactions and closing the books is critical for maintaining consistency within the accounting cycle. Use detailed checklists for monthly closings to ensure all steps, from journal entries to reconciliations, are completed accurately.

You need to perform these bookkeeping tasks throughout the entire fiscal year. At the core of HighRadius’s R2R solution lies an AI-powered platform catering to diverse accounting roles. An outstanding feature is its ability to automate nearly 50% of manual repetitive tasks, achieved through a No Code platform, LiveCube.

- The next step in the accounting cycle is to prepare the unadjusted trial balance.

- This is because all temporary accounts, like revenue, expenses, and dividends, are reset to zero during the closing process.

- Companies may opt for monthly, quarterly, or annual financial analyses based on their specific needs.

- This process ensures a clear, well-organized, and accurate representation of a company’s financial activity, laying the foundation for subsequent steps in the accounting cycle.

- But the payoff for following it is actionable financial information for the business.

Frequently reviewing financial statements and conducting bank statement reconciliations ensures the accuracy of transactions and balances. Additionally, using financial performance ratios or benchmarks can help measure the company’s overall health. Adjusting entries account for items like accrued expenses (e.g., unpaid wages) or deferred revenues (e.g., advance payments for services not yet rendered). These adjustments are necessary because certain transactions may span multiple accounting periods. For example, if rent is paid for six months in advance, an adjusting entry is needed at the end of each month to recognize that portion of the rent as an expense. You’ll achieve this by following a structured 10-step process that begins with a transaction and ends with financial statements letting a company plan expenses, secure loans, or even sell the business.